is actblue donation tax deductible

Contributions or gifts to ActBlue are not deductible as charitable contributions for Federal. At the bottom of the page it clearly states.

Are My Donations Tax Deductible Actblue Support

Contributions or gifts to ActBlue are not deductible as charitable contributions for Federal income tax purposes.

. Contributions must actually be paid in cash or other property before the close of an individuals tax year to be deductible for that tax year whether the individual uses the cash or accrual. When a candidate for a Federal election raises money through. The answer is no.

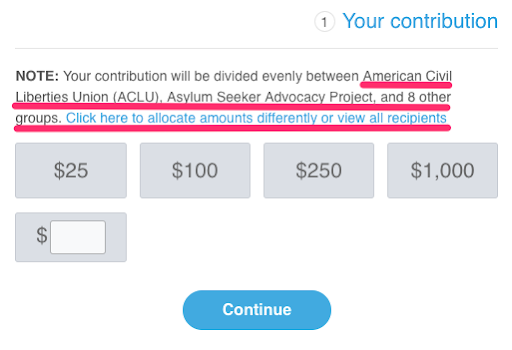

ActBlue does give users the option of giving tips that go to ActBlue itself these tips are the organizations primary source of revenue Donors who save their credit card. Users can find out if an organization had its tax. Here are some key features and functions of the.

Except that for 2020 you can deduct up to 300 per tax return of qualified cash contributions if you take the standard deduction. This rule pertains to both employees and their employers. Donors can use it to confirm that an organization is tax-exempt and eligible to receive tax-deductible charitable contributions.

However donations to ActBlue Charities and other registered 501 c 3 organizations are tax deductible. ActBlue Civics was formed eight years later in 2012. ActBlue Charities is a qualified 501 c 3 tax-exempt organization and donations are tax-deductible to the full extent allowed under.

According to its own estimates ActBlue has helped to raise 24 billion for its clients since its creation. If you made a contribution to a candidate or to a political party campaign or cause you may be wondering if your political contributions are tax deductible. The ActBlue donations page on the website specifically says that the money given will benefit Black Lives Matter Global Network.

Will you make a tax. Classification NTEE Management Technical Assistance Philanthropy. Donations to this entity dont count as tax deductible but you do become a card-carrying member of the ACLU.

For 2021 this amount is up to 600 per tax. According to the IRS. ActBlue is divided into three.

The name of employers must be disclosed when making political donations but more than 47 million donations came from people who claimed they did not have an employer. By proceeding with this transaction you agree to ActBlues terms conditions. If you have an ActBlue Express account we make it easy for you to find your charitable contributions made through our platform.

Tax deductible donations can reduce taxable income. As a service it charges a transaction fee of 395 for each donation it receives and passes along to the final recipient. ActBlue reports to the Federal Election Commission all contributors to Federal campaigns regardless of the amount.

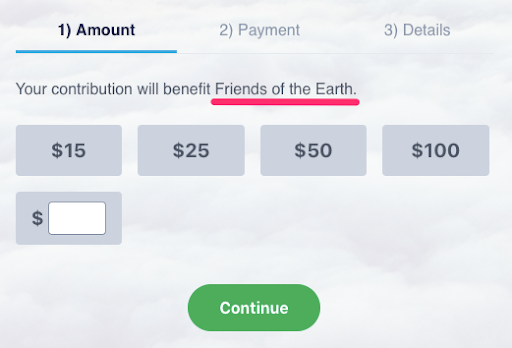

Though giving money to your candidate of choice is a great way to get involved in civic discourse donations to political candidates are not tax-deductible. ActBlue Charities is ActBlues funding platform built specifically for 501c3 organizations which can receive tax-deductible contributions. In fact several other.

SOMERVILLE MA 02144-3132 Tax-exempt since Sept. This cash donation will be classified as an above-the-line deduction when individual taxpayers file their taxes in 2021 reducing both AGI and taxable income. ActBlue Charities is a qualified 501c3 tax-exempt organization and donations are tax-deductible to the full extent allowed under the law.

Tax deductible donations are contributions of money or goods to a tax-exempt organization such as a charity. Donations of 100 or less from outside. The IRS deems donations to eligible 501 c3 nonprofit organizations as tax-deductible.

Taxpayers can use this tool to determine if donations they make to an organization are tax-deductible charitable contributions. ActBlue a platform that funnels donations from individuals to campaigns shows up hundreds of times on Democrats campaign finance filings. ActBlue Virginia PAC campaign finance reports covering January 1 2019 through June 30 2019 on file with Virginia Department of Elections.

The ACLUs dual structure is not unusual.

I Don T Remember Adding A Tip To My Contribution Actblue Support

![]()

Are My Donations Tax Deductible Actblue Support

![]()

Are My Donations Tax Deductible Actblue Support

![]()

Are My Donations Tax Deductible Actblue Support

I Don T Remember Adding A Tip To My Contribution Actblue Support

Are My Donations Tax Deductible Actblue Support

![]()

Are My Donations Tax Deductible Actblue Support

![]()

Are My Donations Tax Deductible Actblue Support

I Donated To A Charity Through A Secure Actblue Com Link Where Does That Money Go Actblue Support

I Donated To A Charity Through A Secure Actblue Com Link Where Does That Money Go Actblue Support

Are My Donations Tax Deductible Actblue Support

![]()

Are My Donations Tax Deductible Actblue Support

Why Don T I See My Donation History When I Log Into My Account Actblue Support

Are My Donations Tax Deductible Actblue Support

Obama Donation Page Donation Page Web Design Landing Page

Actblue Express Lane Actblue Support